Three easy ways to get started with digital banking

Online banking and our convenient mobile banking app put the power of managing your money right at your fingertips.* Check your balance, transfer money between accounts, make a payment and send funds to friends. These are just a few of the many things you can do with just a few clicks of your mouse or taps on your phone.

Browser

This is for anyone who prefers using their web browser to walk through the sign-up process.

Android™

Enroll through the mobile banking app, available on Google Play.**

iPhone®

Sign up directly from the app. Visit the App Store** to download our mobile banking app.

Online and mobile access makes banking easier

If you haven't yet discovered the magic of online and mobile banking, get ready to be impressed. There are so many reasons to love these helpful tools. Here are just a few we know you'll appreciate.

Secure

The latest safety measures including anti-virus protection, firewalls and encryption.

Convenient

Always within reach, whenever you need it. We go where you go!

On your schedule

24/7 access to check your balance, pay bills, deposit checks and more.

Free

Who doesn't love free?

Anytime, anywhere

We go where you go! Now your accounts are as close as your pocket or purse. No need to call us or visit a branch for simple, everyday inquiries and transactions. It can all be done on your time, night or day. Whether you're doing some late-night online shopping and need to check your balance or forgot to pay your friend back for those drinks she covered for you, you can take care of most transactions right from your phone or computer.

Bank when it's convenient for you.

- Check your balance

- Transfer money between accounts or to friends

- Deposit checks (with the mobile app)

- Turn credit/debit cards on and off

- Apply for a loan or open a new account

- Pay bills and make loan payments

- Track spending and deposits

No hassles, no worries

These added benefits of our mobile banking app are designed to save you time, provide peace-of-mind and let you manage your finances from virtually anywhere.

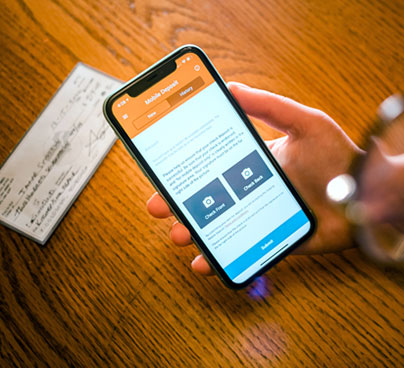

Mobile Deposit

Deposit checks right from your phone! Simply snap a photo of the front and back of your check and choose the account where the funds should go. It's that easy.

Card Controls

Did you misplace your debit card? Turn it off instantly and then turn it back on when you find it in your pocket....right where you put it... (no judgment here)

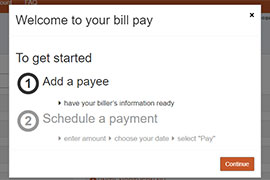

Bill Pay

Say good-bye to writing checks, licking envelopes and looking for stamps! Set up one-time or recurring payments and schedule them in advance for peace of mind.

Our members say it best:

How we safeguard your information

We take your privacy and the protection of your personal data very seriously around here. That's why we use the most current measures available in online security, as well as employ several cutting-edge, proprietary methods to ensure the safety of your online transactions.

Online banking security features include:

- State-of-the-art encryption

- Multifactor authentication

- Automatic timed sign-out

- Unified Threat Management (fraud monitoring)

- Anti-virus and malware protection

- Biometrics

Other ways to stay protected

Develop good password habits

- Use numbers, letters and special characters

- Change your password periodically and never share it

- The longer the better. Use a memorable pass-phrase.

- Don't re-use the same password across multiple sites

- Remember, we will never ask you for your online banking password!

Be cyber-smart and stay safe online

- Never give out personal information such as social security number or login info

- Don't give anyone else access to your phone or computer

- Logout of your online banking session when finished

- Use caution when opening email attachments

- Block unwanted calls and text messages

Common questions about online and mobile banking services

1. Log in to online banking and in the navigation, click on the "Transfers & Payments" category then select "Bill Pay"

2. You'll be asked to set up a security question and accept the Terms and Conditions.

3. It will prompt you to "Add a Payee." Tell us about the person or company you wish to pay.

4. Enter the payment amount and the date the payment should be sent.

5. For recurring payments, select "Make it Recurring" in the payee dashboard.

6. Enter the recurring payment details such as amount, frequency and payment date.

7. Submit!

Follow the steps below to add a payee to Bill Pay

- Log in to online banking

- Select Bill Pay

- Hover over payees in the top left corner

- Select add a payee

- Select what type of payee (company, individual, bank or credit union)

- Once you select you’ll be prompted to answer a security question

- Next, tell us about your payee. For example, if it is going to an individual you’ll need their name and their account number

- Once the information is added, you’ll need to activate the payee by selecting activate payee now and the method you’d like to receive the activation code.

- Once the payee is active, you will be able to schedule payments to this payee.

Within Bill Pay, you’ll have the option to set up a one-time payment, or recurring payments. Log in to online banking and follow the steps below to set up the payment you choose.

Make a one-time payment

- Find your payee on the payments dashboard

- Enter the payment amount and date

- Click Submit all payments

Set up a recurring payment

- Find your payee on the payments dashboard

- Select Make it recurring

- On the next screen, choose the pay from account, payment date, frequency, and first payment date

- Click Submit

To make the switch from paper to electronic statements, follow these four steps.

- Log into online banking

- Locate Settings then click Additional Services

- Select eStatements

- Then choose to change your accounts to eStatements to avoid the $4 per month paper statement fee.

Please note: If you don’t have access to online banking, you will need to enroll in online banking before you sign up for eStatements.

Follow these steps to send money to another member in online banking:

- First, locate Transfers & Payments in the left sidebar and click the dropdown

- Select Make a Transfer

- In the first column, select the account where the funds will be coming from

- In the middle column, select Another Member

- In the last column, indicate when you’d like this transfer to take place, and if you’d like this transfer to be recurring

- Provide and confirm the account number and last name on the account

- You’ll have the option to save this information on your members list for easy transfers to this person in the future

- Enter the payment amount

- You have the option to enter a transaction memo for your records

- Select Transfer Now

- Confirm your transfer info is correct, and select Confirm Transfer

Solarity Online Banking supports the latest versions of Chrome, Safari and Microsoft Edge. We strongly recommend using the latest versions of these browsers to ensure the best and safest online banking experience, as some features may not display or work properly with outdated or unsupported browsers.

Ready to get started?

You have options when it comes to getting signed up for online and mobile banking. You can enroll online first and then download the app. Or, you can download the app and create your account directly from your phone. Either way, you'll be glad you took the plunge! Give us a call if you get stuck. We're here to help.

Online (desktop)

If you like a larger screen for these types of things, enroll in online banking before you download the app.

Start nowTeam Android

Get the app on Google Play and sign up right from your Android device.

Get it on Google PlayTeam iPhone

Visit the App Store, download the app and sign up directly from your iPhone.

Head to the App StoreNeed help?

If you encounter any trouble, give us a call and we'll talk you through it: 1.800.347.9222

Make the call

Helpful articles and information

How to set up alerts in online and mobile banking

Alerts are useful for monitoring your account activity in real time. You can get notified immediately when your balance changes or if there is unusual activity on your ac...

Are mobile deposits safe?

Mobile banking allows you to safely bank on your time from anywhere!

Tips for managing your money online

In this digital age, there are so many tools at our disposal to help manage our money. Solarity Credit Union has you covered.

You might also be interested in:

Home Loans

We'll help you find the perfect loan, whether it's for an upsize, downsize, first home or refinance.

Find your home loan

RV loans

Let us help finance your outdoor fun with loans on campers, motor homes, travel trailers and more

Let's go

Solarity Visa®

Payment versatility and convenient access to your available credit with no annual fee or balance transfer fees.

Spend with ease