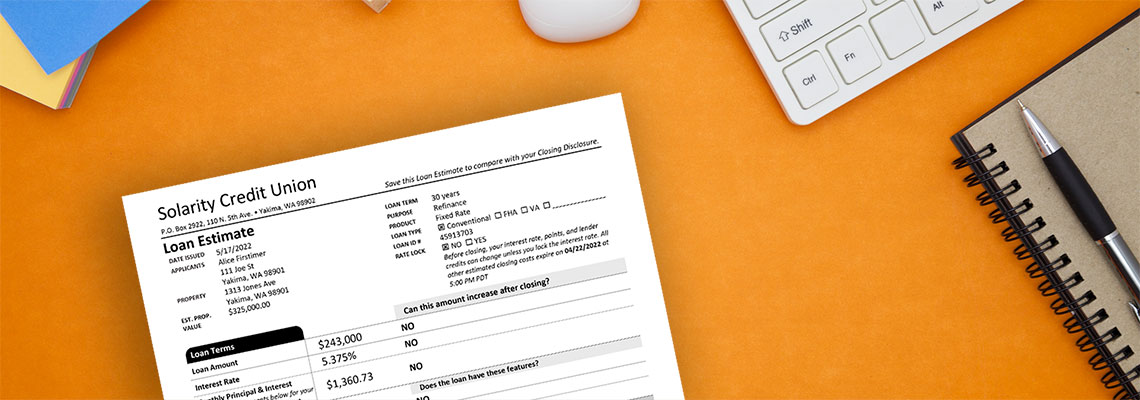

Shopping for a home is an exciting time, especially when you find “the one,” the place you can picture as your future home. Figuring out the financing and how to pay for your new home might seem intimidating, but knowledge is power! And the good news is there is a great tool that helps you easily compare your home loan options: introducing the Loan Estimate. A Loan Estimate is a document you receive from a lender after you apply for a mortgage. By law, a lender must provide you a Loan Estimate within three business days of receiving your home loan application. The Loan Estimate provides the following:

- Estimated interest rate

- Projected monthly payment

- Total closing costs

- Approximate costs of taxes and insurance

- Information on how the interest rate and payments may change in the future

- Any notable stipulations, such as a prepayment penalty or balloon payment. Both of these are risky, so if they show up on your Loan Estimate, ask your lender if there are other options.

The more information you provide the lender about your financial situation, including debts and income sources, the more accurate your Loan Estimate will be. The Loan Estimate is simply that – an estimate of what the lender expects to offer you, should you decide to move forward. It is not an approval (or denial) of your loan application.

Read the fine print

All lenders are required to use the same Loan Estimate form, which makes it easier for you to compare what different lenders are offering. Start by looking at the rate. If you see a lower rate, check your Loan Estimate to see if it includes discount points. With discount points, you pay a one-time fee up front in exchange for a lower interest rate for the life of your loan. The tradeoff is that you may need to bring more cash to closing. Assuming the type of loan (i.e. 30-year fixed mortgage) is the same for all the lenders, the annual percentage rate (APR) is your best comparison tool because it includes both interest rate and fees.

WATCH: Our video explains how points and credits work.

The overall costs of your loan can vary greatly from lender to lender, based on the fees they charge. Look closely at Section A under “Loan Costs” on the Loan Estimate to compare the lender fees. Solarity, for example, has a flat loan origination fee – no matter how much you’re borrowing – whereas many lenders charge 1% of the loan. On a $300,000 mortgage, this would be $3,000. Solarity’s flat fee can save borrowers thousands of dollars.

The Loan Estimate is a critical tool to help you understand what your loan will cost and determine which loan is right for you.

Want to dig deeper and explore each section of the Loan Estimate? Click here for a detailed Loan Estimate Explainer from the Consumer Financial Protection Bureau.

At Solarity, our expert Home Loan Guides will talk with you about your budget and lifestyle and walk you through the possibilities to choose the loan options that work best for you. We offer a variety of mortgage programs and love helping borrowers find the right loan for their unique circumstances. Get in touch today!

What's your Solarity story?

We're on a mission to tell the stories of our members and how they are living their best lives. Do you have a Solarity story to share?