Articles

Requirements to Buy a House in Washington State in 2024

Lush rainforests, stunning mountain peaks and a thriving economy with ample jobs are just a few of the many reasons to live in Washington State.

Are smart homes a good idea?

Smart home adoption is on the rise. But what exactly is a "smart home" and is it a good idea for most homeowners? We explore the pros and cons to help you decide if a sma...

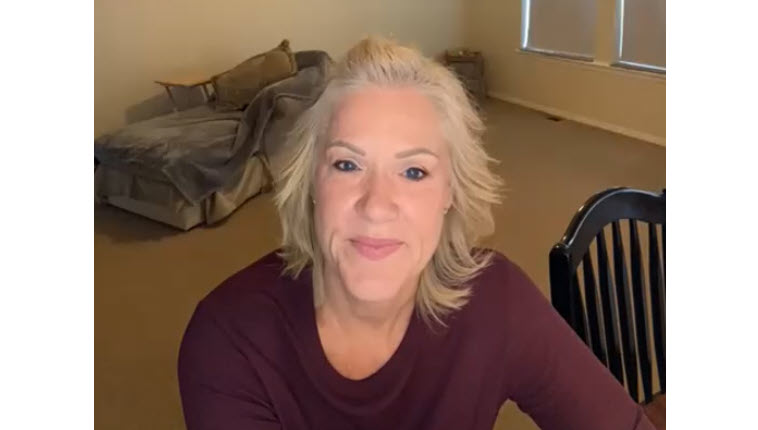

Help with some complicated paperwork: Jeanne's story

Jeanne, a Solarity member since 2016, needed help with some complicated paperwork and called in to chat with the experts in our Member Contact Center. She appreciated the...

9 home improvements that add real value to your life and wallet

Considering a home remodel? Learn which improvements have the biggest bang for your buck and where the most popular home upgrades fall on the cost vs. value vs. happiness...

Am I eligible for a USDA home loan in Washington State?

If homeownership has ever felt like a dream to you, securing a USDA loan could transform that dream into reality.

The #1 thing people get wrong about a mortgage loan in Yakima

Mortgages aren’t the same as they were in decades past – and that’s a good thing. Over the years, a lot has changed to make mortgage loans in Yakima more attainable.

.jpg?sfvrsn=3535603a_1)

What to know when buying a house in Washington State

Being empowered with what to know when buying a house in Washington State will allow you to purchase the home that’s perfect for your lifestyle and budget.

.jpg?sfvrsn=cd337dee_1)

How to buy a home in foreclosure: a buyer's guide

Homebuyers are always looking for creative ways to make their dream of homeownership a reality. In today’s market, thinking outside the box can open doors to unique oppor...

.jpg?sfvrsn=dac8c227_1)

5 factors to consider when choosing the most affordable places to live in the Pacific Northwest

The Pacific Northwest is a great choice for affordable housing, and it’s a popular one if you’re moving from the other side of the Rocky Mountains.