What are you searching for?

Online Banking

You are eligible to make an external transfer if:

- you are 18 years of age or older,

- you have a street address on file with us (P.O. Boxes are not eligible),

- you have a Solarity personal checking, savings or money market account or an eligible Solarity mortgage, loan, line of credit or other personal account and

- you have an eligible external account at another U.S. financial institution.

*We reserve the right to remove availability of this service at any time without warning. Please see Membership Account Agreement Electronic Funds Transfers section to learn more.

**At this time, business accounts are not eligible to make external transfers.

An external deposit account at another U.S. financial institution is eligible as long you are:

- the primary owner of the external account,

- a joint owner of the external account, or

- authorized by all owners of the external account to transfer funds to or from the external account.

An external transfer is an electronic transfer of money to your Solarity account from your eligible external account at another U.S. financial institution.

External transfers also allow you to transfer funds to your external account from your Solarity account.

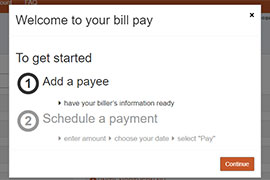

1. Log in to online banking and in the navigation, click on the "Transfers & Payments" category then select "Bill Pay"

2. You'll be asked to set up a security question and accept the Terms and Conditions.

3. It will prompt you to "Add a Payee." Tell us about the person or company you wish to pay.

4. Enter the payment amount and the date the payment should be sent.

5. For recurring payments, select "Make it Recurring" in the payee dashboard.

6. Enter the recurring payment details such as amount, frequency and payment date.

7. Submit!

Solarity Online Banking supports the latest versions of Chrome, Safari and Microsoft Edge. We strongly recommend using the latest versions of these browsers to ensure the best and safest online banking experience, as some features may not display or work properly with outdated or unsupported browsers.

To make the switch from paper to electronic statements, follow these four steps.

- Log into online banking

- Locate Settings then click Additional Services

- Select eStatements

- Then choose to change your accounts to eStatements to avoid the $4 per month paper statement fee.

Please note: If you don’t have access to online banking, you will need to enroll in online banking before you sign up for eStatements.

Traveling is always an exciting time! One thing we don’t want you to worry about is access to your funds. However, traveling can cause a fraud alert on the card, which could restrict access to your funds.

The best way to avoid that if you are planning on traveling, is to add travel notes to your debit card and credit card. Then, if you use your card in the location you travel to, you won’t have any issues with using your funds.

To add travel notes to your cards, call us at 800.347.9222 (select option 6). You can also add a travel note through the Solarity mobile app under "card controls."

You should be able to and if you're having issues, chat with us or call us at 800.347.9222.

Regulation D was a former federal regulation that limited withdrawals or outgoing transfers from a savings or money market account to no more than six non-signature transactions per month. However, the federal government suspended it during the COVID-19 pandemic.

Prior to April 2020, you could only transfer funds out of your savings account 6 times each month without providing a signature.

Once the monthly limit was reached, you could still make transfers without visiting a branch by using an ATM where your PIN acts as a digital signature.

If you have any questions regarding Regulation D, feel free to give us a call at 800.347.9222 or chat with us online.

Still have questions?

If you aren't able to find the answers you need, reach out to us. We are happy to help!