Checking that pays

With unlimited transactions, Dividend Checking provides all the convenience you want for your everyday banking letting you pay bills, make purchases, transfer funds and get paid faster with direct deposit.1 You also have 24/7 access to your account through online banking or our mobile banking app.2

Dividend Checking does everything you need it to. Plus, your money isn't sitting idly by...it's earning a monthly dividend, with higher rates for higher balances.

Opening an account is easy! You can apply online in just a few minutes.

Dividend Checking rates

Tiered rates: earn a higher rate for higher balances

Here's the scoop on Dividend Checking

Dividend Checking gives you more of what you really want....convenient, drama-free access to your money while also earning dividends.

Earn a return

Put your money to work for you! The higher the balance, the more you earn.

Convenient

Make purchases, write checks, transfer funds, withdraw cash and more!

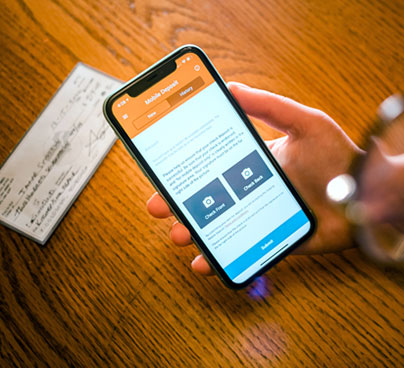

Online and mobile banking

24/7 access! Pay bills, deposit checks, manage your accounts. Anytime, anywhere

Access to 30,000+ ATMs nationwide

The Co-Op Network offers surcharge-free ATMs throughout the U.S.

Everything you need from a checking account ... and more!

- Earn a dividend

- Direct deposit and ACH options

- Online and mobile banking

- Monthly service charge waived with $250 minimum daily balance

- Free overdraft transfers

Our members say it best:

Compare checking accounts

If you prefer no monthly service charge, you'll like Free Checking. If you plan to maintain a higher balance and would like to earn a dividend in the process, Dividend Checking might be the way to go. Either way, we've got you covered, with automatic enrollment in Courtesy Pay.3 If your checking account doesn't have enough available funds, Courtesy Pay covers checks, recurring payments tied to your checking account number and bill payments scheduled in online banking or the mobile app.

| Checking Products | Free Checking | Dividend Checking |

|---|---|---|

| Annual Percentage Yield (APY) | N/A | See today's rates |

| Minimum balance to earn APY | N/A | $250 |

| Minimum opening deposit | $50 | $100 |

| Monthly service charge | N/A | $6 |

| Minimum balance to avoid monthly service charge | N/A | $250 |

Both checking accounts include:

- Unlimited transactions

- Online banking and mobile app

- Free overdraft transfers

Ready to open a Dividend Checking account?

We make opening your account FAST and EASY! There are three simple ways to get started:

By phone

Reach our friendly team members at 800.347.9222 during our normal business hours. We'll explain the products and get you ready to open your new account.

Call nowAt a branch

Stop by any of our local branches and speak with one of our helpful branch experts.

See locations

Common questions about checking accounts

Click on the “Open an Account” button.

Once you’ve selected the type of account you’d like to open, the application will walk you through what's needed to complete the process.

If you need assistance, call us at 800.347.9222. We'll be happy to help.

Follow the steps below to deposit your check using mobile deposit:

- On the Accounts screen, click the Quick Menu icon located in the bottom right corner.

- Click Mobile Deposit.

- Use the Choose Account drop-down to select the account where you want to deposit the money.

- In the Amount box, enter the amount you want to deposit.

- Take a picture of the front and back of your check and follow the on-screen instruction to upload the photos.

- Click Submit to complete the mobile deposit.

Download our app in the App Store or Google Play store.

Get more from your membership

Mobile App

Manage your accounts anytime, anywhere from the palm of your hand. Pay bills, deposit checks and more!

Get the details

IRA Certificates

Enjoy the security of a guaranteed return and tax-advantaged savings – without the uncertainty of market volatility.

Grow your nest egg

Bonus Savings

Get rewarded for using your debit card and earn a great rate with no monthly service fees.

Learn how it worksHelpful articles and information

Big news! Solarity announces new Union Gap branch location

Solarity is building a brand-new branch at 1249 Market Street—right near Winco and Costco. Get a sneak peek at what’s coming!

.jpg?sfvrsn=1573f8f3_1)

What is an emergency fund and why do you need one?

Wondering how to handle life’s “what ifs”? An emergency fund can give you peace of mind when the unexpected hits. Find out how much to save, where to keep it, and simple ...

How to add a card to your digital wallet

Going cashless? Smart move! Digital wallets make payments fast, safe and simple. No matter what device you use, adding a card to your digital wallet is quick and easy.

Annual Percentage Yield (APY) accurate as of date shown and subject to change. $6 monthly service fee waived with $100 minimum balance; fees may reduce earnings.

Early access to direct deposit funds is not guaranteed. It is subject to the payer and the timing of the payer's submission of the payment file. We generally make these funds available on the day they are received, which may be up to 2 days earlier than the scheduled payment date.

Message and data rates may apply depending on your cell phone plan. Please contact your wireless carrier for more information.